Looking to make some big purchases? Your credit score might make or break those decisions. Credit scores are like your financial resume and they communicate to lenders what kind of money borrower you are. Lenders only want to lend money to someone who has proven that they borrow money but then pay it back reliably and consistently. No one wants to lend money to someone who has a history of late payments and are unpredictable.

As a property management company, we have promised our homeowners that we will locate responsible tenants for their properties that will pay on time. By looking at your credit score, we can determine if you are the reliable tenant we promised to find. Here are some things to keep in mind if you want to improve your credit score:

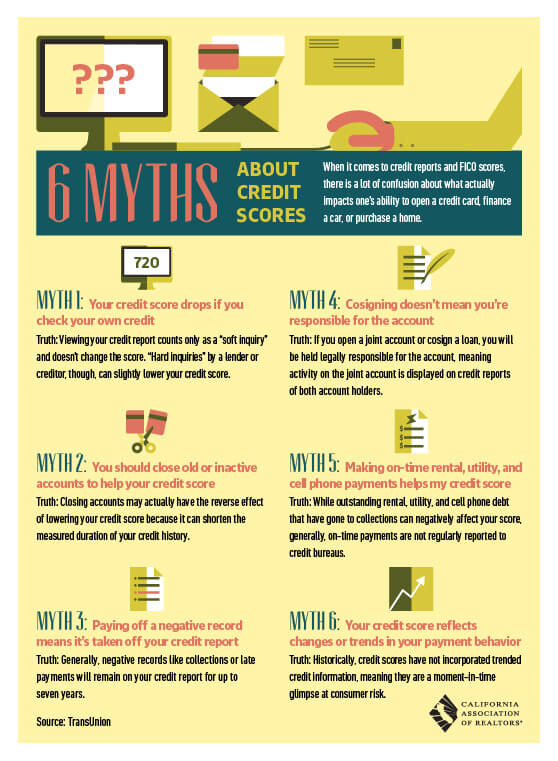

Check Your Score The first thing you do to improve your credit is to pull your report and see where you stand. Everyone receives one free credit score check a year (visit AnnualCreditReport.com) from each of the Credit Bureaus. You can maximize your free information by ordering your score from one bureau every four months. This report will tell you what your score is, how many accounts you have and how old they are, and if you have any late or outstanding payments. This will give you the info you need to begin improving your credit history. P

ay Your Bills According to Experian Credit Bureau, the biggest thing a person can do to maintain a great credit score is to pay all bills on time (35% of your score is based on payment timing alone). Businesses want their money so they only want to work with people that will pay their dues on time. Setting reminders and setting up automatic bill pay is a great way to make sure you don’t accidentally forget a payment.

Time is of the Essence The thing about credit scores is it takes time for any action to make a difference on your score. Improving your score (or decreasing your score) does not happen immediately. Generally, it takes seven years for late payments to disappear off of your record. So make your adjustments as soon as possible so you increase your length of good credit history.

Keep the Good Stuff Many people are tempted to remove any accounts from their credit history as soon as it is paid off (such as paying off the credit card). They assume any record of previous credit debt is a bad thing so they want to remove the evidence. This is a mistake because you want to have this on your credit history so you prove to prospective lenders that you are capable of paying off loans. Just like your job resume, you want to show off your accomplishments to future investors. When North County Property Group examines a potential tenant for one of our rental properties, there are a lot of factors to take into consideration. A great credit is one of the main factors and will usually bump you to the top of our list of potential candidates.

Follow North County Property Group on our Blog, Facebook , Twitter, Y

Contact us today: 1-800-436-2235 / info@ncpropertygroup.com